As it seems these days, my path down a rabbit hole begins with someone else's innocuous LinkedIn post. Essentially the premise was that Thomas could have purchased a Tesla without ever having stepped inside a showroom and used Apple Pay to complete a digital transaction fully. The related article talked about the need for fully immersive experiences that allowed buyers to experience the features of the car. And if done properly, there didn't have to be any human interaction in what historically has been a human-intensive process. Side note – the ability to pay for a Tesla with Apple Pay. Mind-blowing.

We've spoken a lot internally recently about Gen Z decision makers rapidly entering our ecosystem. The Sydney Morning Herald recently published an article stating that the phone call is relegated to 'boomers'. These decision-makers are looking to complete their buying cycle without ever talking to a real person. The phone call is seen as being intrusive. The impact on the traditional SDR/BDR model here is enormous.

This raises the challenge that marketers and salespeople have relied upon for years, the personal and human connection.

It's irrefutable that the B2B buying journey has changed. And COVID, like it or not, has changed it immensely.

How do you establish relationships when you've never met a person?

The focus shifts from that in-person relationship to the emotive response your content builds. The lightbulb moment when the buyer goes, yes, this is what I need. Or, that was useful. I'll keep that link. It's about being constantly present across your channels.

In our recent blog post on Changing buyer priorities, we touched on the increase in the buying group size. That for 62% of businesses, it's now four to nine people. When you're targeting a buying group, that research and validation process is no longer linear. It's not about one person consuming your content in the order you planned for them.

Gartner recently published the 'New B2B Buying Journey and its Implication for Sales' and called out some interesting statistics. When B2B buyers assess multiple options, they only spend 5-6% of the cycle meeting with the relevant suppliers.

This reinforces our statement that they've done their due diligence by the time the buyer has reached out to you, and you're most likely on the shortlist. Every consumer or B2B buyer understands the value of their contact details. Nobody wants to be spammed. Nobody wants to be called ten minutes after downloading a white paper. They want time to digest the information you've made freely available to them. Because if you've not made it freely available, someone else most likely has.

It's irrefutable that the B2B buying journey has changed. And COVID, like it or not, has changed it immensely. In many ways, the B2B buying cycle now partially reflects B2C in terms of information gathering. You need to create a digital experience. You need to be easily accessible digitally. Half the challenge is about being easy to find in a complex and crowded landscape.

It's also about taking your navel gazing lens off. It's about offering value and knowledge to your customers in return for what feels like potentially nothing for a long time. Why is this important?

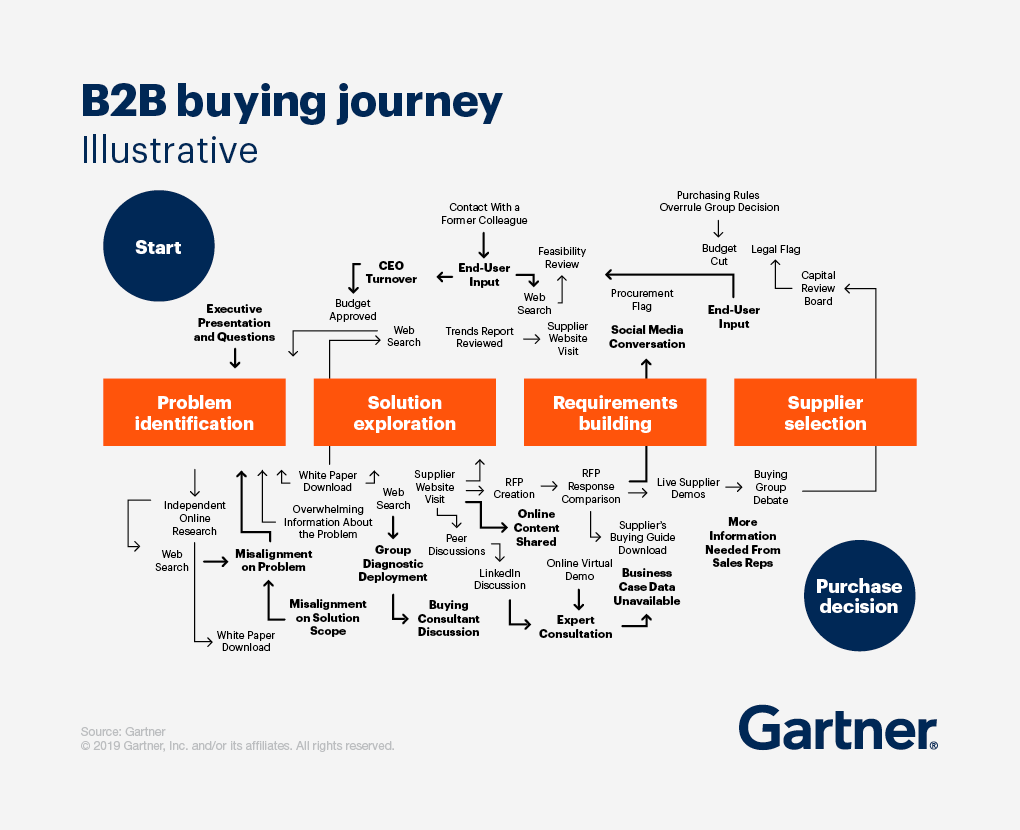

Because of this (above). It's by no means the most common buying cycle, but we can all relate to different steps across this cycle. This illustrative buying process shows 12 online touchpoints, from web searches to white paper downloads. We also know that B2B buyers still heavily lean into LinkedIn for peer reviews and feedback. However, beware of jumping into a discussion stream with a cold pitch.

Every content piece doesn't need to be tied back to your product or solution. More often than not, buyers want to know that you understand their industry. That you understand the challenges their business faces. It also caters to the different lens through which each of your buying decision makers is looking at this issue. With the large-scale investment we are often dealing with within this industry, there are conflicting internal priorities and understanding of the issue. It still comes back to the simple premise of building trust with your buyers.

How do you make a complex buying decision easier?

By providing the right content at the right time. What is the right time? When your buyer is searching for it. Whether that's 9pm on the couch on their phone or 2pm at their desk. Gartner states that for those buyers, that information was helpful; it made the buying process 2.8 times easier. Easier means faster movement through the funnel.

So, what does this really all mean?

- You can't necessarily measure your funnel height by the type of content consumed

- Prospective buyers aren't going to follow the path you think they will (or you plan for them)

- Ensure your content addresses business issues. What problem is this going to fix? How is it going to fix it?

- Build your content to make sense in stand-alone fashion, or reference previous materials within the content for context

And what I believe to be the most important point.

Accessibility is key. This is about them. Not about you.